Individual Tax Returns Are Due On For Calendar-Year Individuals. – “Taxpayers have extra time – up to six months after the due date of the taxpayer’s federal income tax return for the disaster year (without regard to any extension of time to file) – to make the . Know How Many Times You Can Revise Return calendar and stay ahead in managing your taxes! Below are the ITR filing deadlines that various categories of taxpayers must adhere to for the financial .

Individual Tax Returns Are Due On For Calendar-Year Individuals.

Source : www.investopedia.com

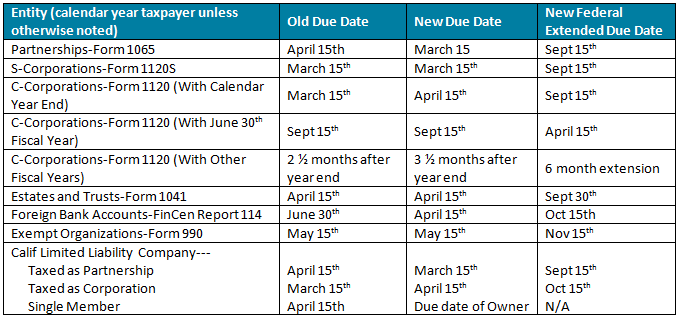

Federal Income Tax Deadlines

Source : www.thebalancemoney.com

Don’t Be Surprised By New Tax Filing Due Dates | San Jose CPA Firm

Source : www.aslcpa.com

Filing an Amended Individual Tax Return GYF

Source : gyf.com

Neighborhood Real Estate added Neighborhood Real Estate

Source : m.facebook.com

2023 tax calendar Accuity LLP

Source : www.accuityllp.com

Alfonso Guerra, CPA on LinkedIn: Upcoming Tax Due Dates and more

Source : www.linkedin.com

CG CPAs, Inc

Source : www.facebook.com

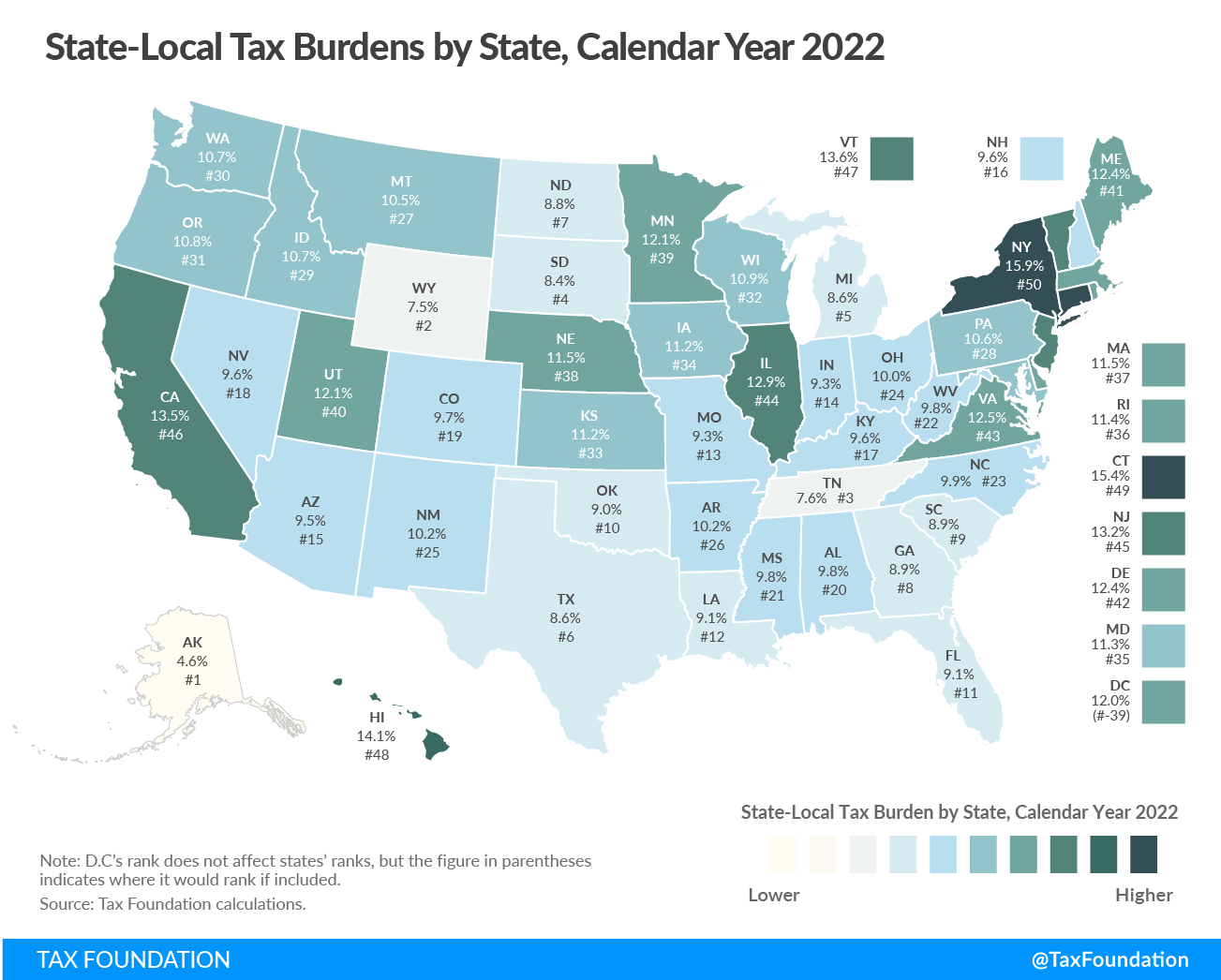

State and Local Tax Burdens by State | Tax Foundation

Source : taxfoundation.org

CG CPAs, Inc

Source : www.facebook.com

Individual Tax Returns Are Due On For Calendar-Year Individuals. What Is the Tax Year? Definition, When It Ends, and Types: The Internal Revenue Service ( IRS) has announced tax relief for individuals and businesses in parts of Kentucky and West Virginia affected by severe storms, straight-line winds, tornadoes, landslides . UPDATE: The due date of ITR filing for businesses (subject to audit) has been extended to October 31, 2019. The above ITR filing dates are for those filing income tax returns for their earnings during .

:max_bytes(150000):strip_icc()/taxyear-c3f5618cd504499583b0543cb4d6b31e.jpg)

:max_bytes(150000):strip_icc()/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)