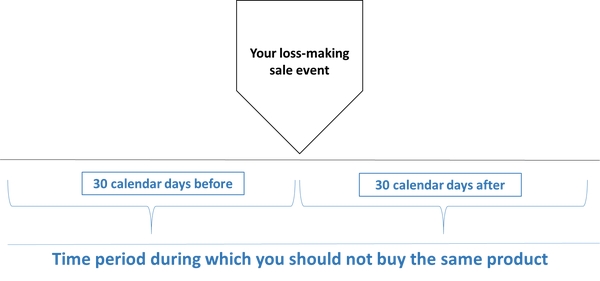

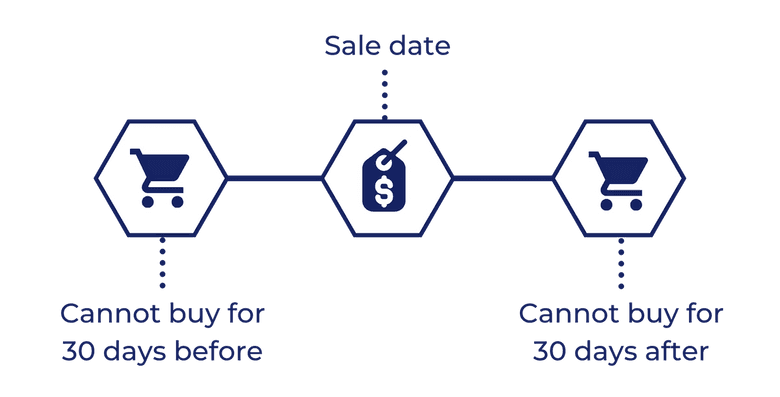

Wash Sale Rule 30 Calendar Days – If you sell stock or securities for a loss, the wash sale rule applies if you acquire one of the following within 30 days before or after the sale: Substantially identical stock or securities in a . If you sell stock or securities for a loss, the wash sale rule applies if you acquire one of the following within 30 days before or after the sale: Substantially identical stock or securities in a .

Wash Sale Rule 30 Calendar Days

Source : www.fool.com

Tax Information and Reporting Wash Sales | Interactive Brokers LLC

Source : www.interactivebrokers.com

What Is the Crypto Wash Sale Rule? | Bybit Learn

Source : learn.bybit.com

For your year end tax planning, beware the wash sale rule | J.P.

Source : privatebank.jpmorgan.com

For Your Year end Tax Planning, Beware the Wash Sale Rule | J.P.

Source : www.jpmorgan.com

Understanding Wash Sale Rules to Optimize Capital Gains

Source : fastercapital.com

Stock Trading Pitfall: The Wash Sale Rule | Sodowskylaw Virginia

Source : sodowskylaw.com

What Is the Crypto Wash Sale Rule? | Bybit Learn

Source : learn.bybit.com

Avoid Wash Sales On Your RSUs | Candor

Source : candor.co

Wash Sale Rule: What To Avoid When Selling Your Losing Investments

Source : www.bankrate.com

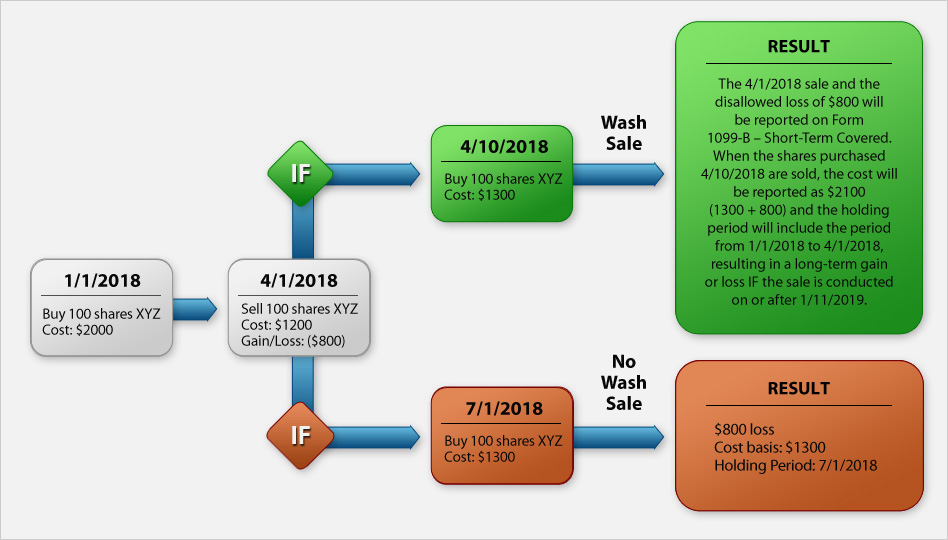

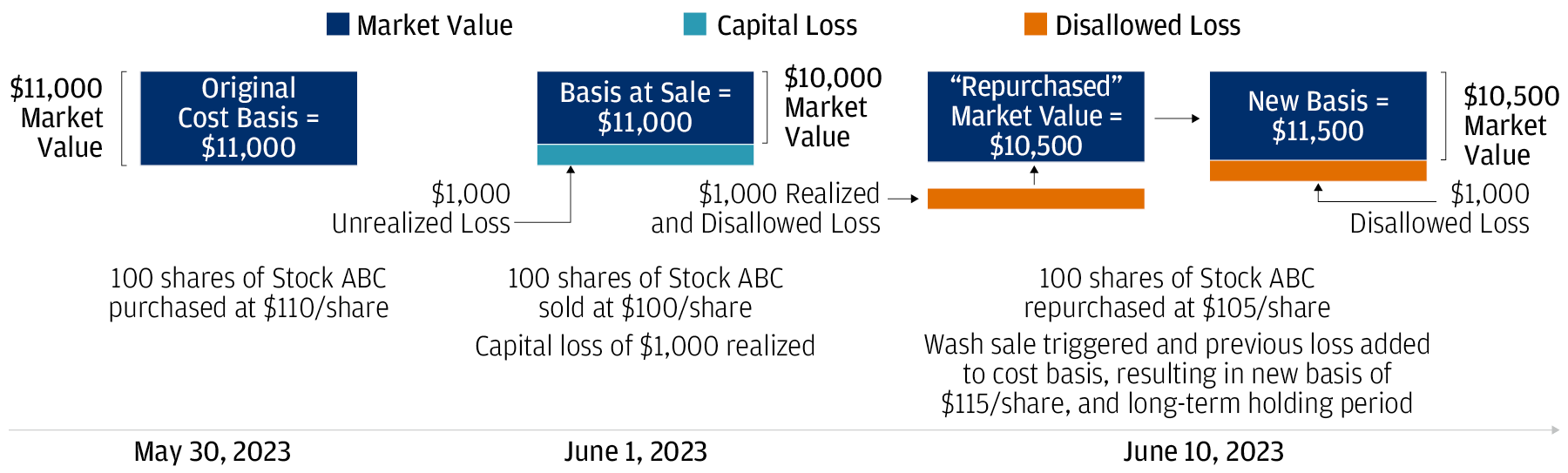

Wash Sale Rule 30 Calendar Days Wash Sale Rule: What it is and How to Avoid | The Motley Fool: A wash sale occurs when an investor sells an asset for a loss but repurchases it within 30 days attention to this rule. You’ll only have until the end of the calendar year to position . On its surface, the wash sale rule isn’t very complicated. It simply states that you can’t sell shares of stock or other securities for a loss and then buy substantially identical shares within 30 .